When planning on doing some construction work, investors and other parties usually turn to the quantity surveyor reports in order to plan their construction costs better. The QS report helps investors have a better overview of the entire project cost and better plan their entire investment projects.

What is a Quantity Surveyor Report?

A quantity surveyor report is used for assessing tax deductions caused by the depreciation of the investment property. The depreciation is caused by outlining annual deductions of the property. This report is also known as :

- Capital Allowance and Tax Depreciation Schedule, or

- Depreciation Schedule / Report.

QS reports are prepared by qualified and registered quantity surveyors, professionals who specialise in estimating construction costs in all stages of a construction project.

What is a Quantity Surveyor?

A quantity surveyor is a professional who specialises in the estimation of construction costs in all phases of a construction project. Moreover, quantity surveyors also calculate the actual cost of residential and commercial properties after the project’s completion and use that data to create tax depreciation schedules that have to be ATO compliant.

Types of QS Reports

QS reports are considered an industry standard and are used widely in the building industry as one of the main tools for better cost planning. There are two main types of quantity surveyor reports:

- a cost report,

- tax depreciation report.

Cost Report

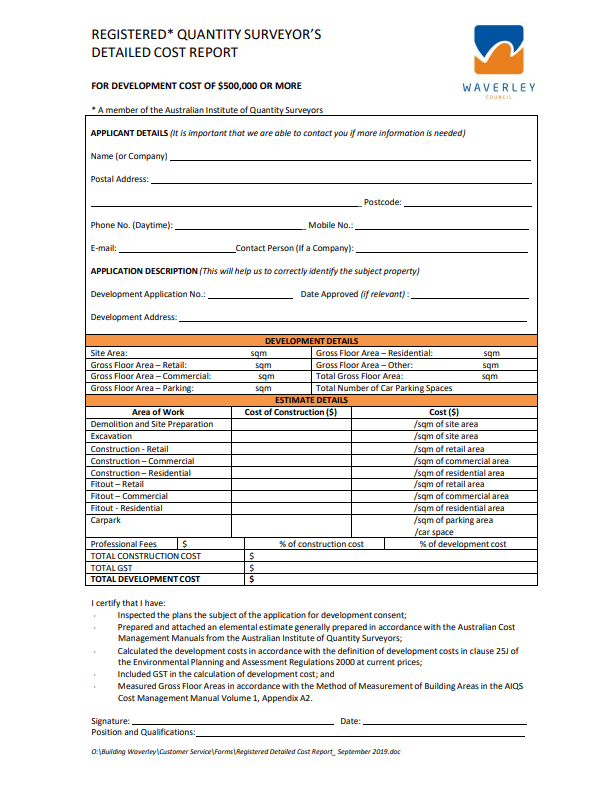

Each council has various requirements that construction companies must meet in order for their Development Application (DA) to be approved. Most councils will require a detailed Cost Report if the estimated cost of construction will exceed a limit specified by the council. This is typically somewhere between $500 and $3,000,000 – each council varies.

A cost report, which is provided by a registered quantity surveyor, verifies the construction costs of a development project and thus allows the council to accurately calculate fees that the developer must pay. If you’re submitting a cost report as part of your DA, then you must meet the following requirements:

- Comply with section 25J of the EPAA 1979

- Make sure that your report is prepared by a registered quantity surveyor who is a member of the AIQS.

- Follow specific requirements and formatting, which have been defined by the individual council when you’re submitting your cost report.

Tax Depreciation Report

The Australian Taxation Office (ATO) will allow a developer to demand the decline in value of the building through the tax deduction. An asset can be subject to tax deductions if you are using it for investment purposes.

A Quantity Surveyor can prepare tax depreciation schedules after a construction project has been completed. This is a crucial document for investors who want to claim tax benefits. Depending on the age and value of the building, the deducted amount varies between 2.5% and 4% of the capital works per annum.

The benefits of tax deductions can be significant for both residential and commercial assets. Investors can save up to $10,000 per year. Throughout Australia, when calculated accordingly, the amount of money that adds up through the tax deductions can go up into millions of dollars.

To be eligible for a tax deduction, an investor should hire a quantity surveyor or tax depreciation firm. They will perform an inspection of the real estate and will then conduct a depreciation schedule based on the on-site analysis of a quantity surveyor. The analysis needs to be undertaken by a registered company. Otherwise, the ATO will not accept calculations of the tax depreciation benefits for an investment property.

When a quantity surveyor creates their report, they will perform the following tasks:

- Take photos of the property

- Gather information about the age of the property

- Note the materials used for construction

- Estimate the value of window and door treatments, as well as appliances and internal fittings.

When the Quantity Surveyor completes their report, it should be handed to an accountant, who will then calculate the tax benefits that the investor will receive that year.

After the initial report is made, the investor only needs to have it updated by the accountant. There is no need to make a new report each year. For example, if the investor renovates the bathroom, or paints the wall, the account will add those details to the original report.

Quantity Surveyor Report PDF Example

Below, we’ve included an example QS report in PDF—that has not been filled out—which is required by Waverley Council in NSW.

[su_button url=”https://pbaqs.com.au/contact-us/” background=”#7D0133″ size=”6″ icon=”icon: envelope-o” desc=”Get your QS report today!”]Contact us[/su_button]

How much does a QS report cost in Australia?

The cost of hiring a quantity surveyor in Australia differs on the work and types of reports. Usually, the quantity surveyor fees start around $200-$350 + GST for self-assessment reports for residential properties. On the other hand, full QS reports can cost anywhere from $400-$700 + GST.

Quantity surveyors are often hired on a defined percentage of the total contract cost that goes from 0.5% up to 2%, but it can vary to a great extent.

In terms of hourly rates, the average hourly rate of quantity surveyors is around $61 per hour, but it can be different (often higher) if a quantity surveyor is self-employed.

Why is the Quantity Surveyor (QS) Report important?

A quantity Surveyor report is a necessity and an integral part of any construction project for a variety of reasons:

- It provides accurate tax deductions for commercial or residential assets,

- It prevents making deduction errors which result in significantly higher costs,

- It reduces the possibilities of project delays caused by improper planning and deductions,

- QS report is mandatory when seeking funding from Financial Institute Lender

To maximize the benefits of a QS report, hire experienced cost and tax professionals, such as our company, with over 20 years of industry expertise.

Get your QS report today with PBAQS

Why hire us for your QS report? Property & Building Assessments Pty Ltd has been in the industry for more than 20 years and has been involved in various building and construction projects. We always keep pace with the legal changes in the industry and create added value for our clients in every stage of their building projects.

At PBAQS, we provide Cost Reports for $450 and offer a quick turnaround time. If you need a QS report, feel free to call us at (02) 9522 6407 or send a quote via info@pbaqs.com.au.

[su_button url=”https://pbaqs.com.au/contact-us/” background=”#7D0133″ size=”6″ icon=”icon: envelope-o” desc=”Get your QS report today!”]Contact us[/su_button]